I started writing up my proposal for the Open Source Real Time eXchange on the site y-intercept.com. I have to take Coco for a walk. I will spend the night adding articles to the proposal.

The important news is that I just submitted my entry for the proposol on the DeepCapture Crack the Cover-Up essay contest. My entry is under the name "yintercept" it starts with the words: "Competition drives the free market."

If you like the idea; Vote for It!

BTW, you might notice that I've written several essays with links to Deep Capture. I wrote the posts and made the links because I believe DeepCapture is saying something important.

I did not know about the essay contest until yesterday. I wrote this post and my last post (Open Source Real Time eXchange) because I want to win the competition.

If you like the idea of a new open source stock exchange. Go to this page, find my entry and vote for me!

Pages

▼

Tuesday, September 30, 2008

Open Source Real Time eXchange

In recent posts, I've been ranting about abuses in the Stock Market.

Truth be told. I prefer doing to ranting.

IMHO, the problems in the current market result from gaps in the securities traded and the real items that the securities represent.

A driving force in the 2008 market collapse was the fear that bundles of mortgage backed securities were rife with bad loans. The market froze and banks collapsed as people lost confidence in the value of the securities.

Gaps in the trading system made things worse. As people lost confidence in securities, Hedge Funds hit the market with an unprecedent barrage of short selling. In the current regulatory regime, there is a multiday gap between a trade and transfer of the stock. During the market crash, there was an increase in the failures to deliver stock purchased.

It appears that these Failures to Delivered artificially accelerated the crash.

The crash was caused by investment tools that do not accurately reflect the real items behind paper securities. IMHO, the solution is to create a new exchange with fewer gaps.

Anyway, I just registered the domain name OSRTX.com. The acronym stands for Open Source Real Time eXchange.

Unfortunately, a blog is not the right format for writing a proposal. As such, I will place the proposal on the page called The Shared Equity project.

Truth be told. I prefer doing to ranting.

IMHO, the problems in the current market result from gaps in the securities traded and the real items that the securities represent.

A driving force in the 2008 market collapse was the fear that bundles of mortgage backed securities were rife with bad loans. The market froze and banks collapsed as people lost confidence in the value of the securities.

Gaps in the trading system made things worse. As people lost confidence in securities, Hedge Funds hit the market with an unprecedent barrage of short selling. In the current regulatory regime, there is a multiday gap between a trade and transfer of the stock. During the market crash, there was an increase in the failures to deliver stock purchased.

It appears that these Failures to Delivered artificially accelerated the crash.

The crash was caused by investment tools that do not accurately reflect the real items behind paper securities. IMHO, the solution is to create a new exchange with fewer gaps.

Anyway, I just registered the domain name OSRTX.com. The acronym stands for Open Source Real Time eXchange.

Unfortunately, a blog is not the right format for writing a proposal. As such, I will place the proposal on the page called The Shared Equity project.

Monday, September 29, 2008

Market Hyperactivity

Apparently one of the prime reasons that the market started allowing short selling of stock some 300 hundred years ago was "market efficiency."

Traders used to have to send messages afoot or on horse to arrange a sale. As riding horses for long distances gets old after awhile, people were open to tools that would make trading more efficient. Shorting a stock allows gentlemen traders to make a deal, then send a rider to get the stock later to clear the transaction. Combining carriage rides is efficient.

Today's communication technology obliviates most of the concern with market efficiency. If anything, today's market is suffering from hyperactivity. The trades take place faster than real information.

I am looking at Yahoo Charts. The chart currently indicates that over 100 million shares DJIA stock traded during September 29th sell off.

The cause for this sell off is that people don't know how to price mortgage backed securities. Consequently, they don't know how to price any stock that might have a dependency on such securities. To add more unknowns, they don't know the form of the bailout.

Trillions of dollars traded hands based on lack of knowledge, and herd movement.

We are in an age of trading hyperactivity. Artificial tools like the short sell, which were designed in a day when horses were common on Wall Street, just add to the turmoil.

Traders used to have to send messages afoot or on horse to arrange a sale. As riding horses for long distances gets old after awhile, people were open to tools that would make trading more efficient. Shorting a stock allows gentlemen traders to make a deal, then send a rider to get the stock later to clear the transaction. Combining carriage rides is efficient.

Today's communication technology obliviates most of the concern with market efficiency. If anything, today's market is suffering from hyperactivity. The trades take place faster than real information.

I am looking at Yahoo Charts. The chart currently indicates that over 100 million shares DJIA stock traded during September 29th sell off.

The cause for this sell off is that people don't know how to price mortgage backed securities. Consequently, they don't know how to price any stock that might have a dependency on such securities. To add more unknowns, they don't know the form of the bailout.

Trillions of dollars traded hands based on lack of knowledge, and herd movement.

We are in an age of trading hyperactivity. Artificial tools like the short sell, which were designed in a day when horses were common on Wall Street, just add to the turmoil.

Wall Street Greed

People should be up in arms at Wall Street greed.

The problem is that the current market is not being driven by long greed.

The downturn in the market is currently driven by short greed.

Yes, the dotcom bubble had irrationally exuberant traders pumping wild amounts of capital into pipe dreams.

The current problem is with the same irrational dream but run by people shorting the economy with hopes of reaping the whirlwind as companies collapse in the downturn.

Yes, I hate the bill put forward by Congress; However, I support having the Congress buy up large swaths of mortgages on the market because, quite frankly, we have more to fear from the people who are manipulating the economy downward than from the people who were buying up mortgage portfolios thinking that they were a safe investment.

The wanks selling the subprime loans were wanks who really truly legitimately thought they were helping people by putting them in houses that the newbie homeowner could not afford. Yes, they are greedy, but it is a stupid greed.

The people shorting the living crap out of the market are slugs of the worst lot.

Wall Street greed is such that the the ne're-do-wells win on both the upside and downside ... they actually do best on the downside.

The problem is that the current market is not being driven by long greed.

The downturn in the market is currently driven by short greed.

Yes, the dotcom bubble had irrationally exuberant traders pumping wild amounts of capital into pipe dreams.

The current problem is with the same irrational dream but run by people shorting the economy with hopes of reaping the whirlwind as companies collapse in the downturn.

Yes, I hate the bill put forward by Congress; However, I support having the Congress buy up large swaths of mortgages on the market because, quite frankly, we have more to fear from the people who are manipulating the economy downward than from the people who were buying up mortgage portfolios thinking that they were a safe investment.

The wanks selling the subprime loans were wanks who really truly legitimately thought they were helping people by putting them in houses that the newbie homeowner could not afford. Yes, they are greedy, but it is a stupid greed.

The people shorting the living crap out of the market are slugs of the worst lot.

Wall Street greed is such that the the ne're-do-wells win on both the upside and downside ... they actually do best on the downside.

The Rise and Fall of WaMu

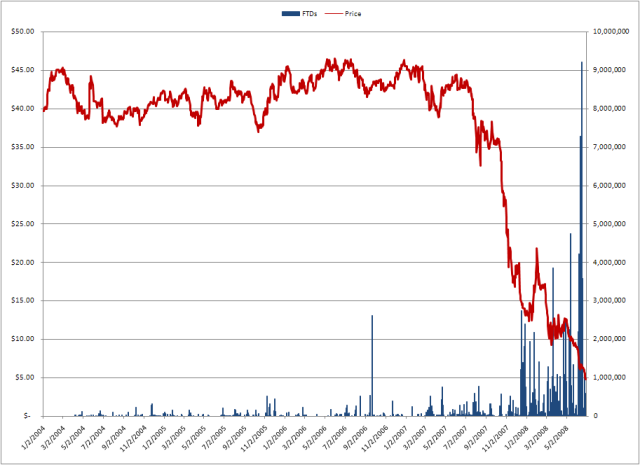

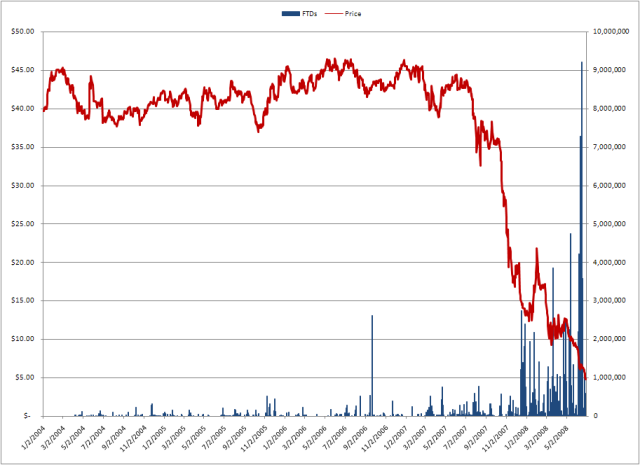

On the post Shorts Say WooHoo!, I deep linked a graph from DeepCapture.com showing the role FtDs played in the final days of Washington Mutual. It was heartbreaking to see a company that played an important role in many lifes go up in a puff of questionable paper.

Truth be told, I was actually more disheartened by the rise of Washington Mutual from a wonderful little local mutual fund to a banking behemoth. I extracted the list of WaMu acquistions from Wikipedia.

Quite frankly, I was more disheartened by the slow played drama of all these wonderful little banks being vacuumed up by a corporate giant, than in watching the thunderous collapse of the corporate giant.

Mergers are not one sided. Yes, some mergers are the result of hostile take overs. My understanding in the Washington Mutual expansion is that many of the small banks were seeking protection of a larger company. Regulations like the Community Re-investment Act (established in 1977 and greatly expanded in 1995), put tremendous regulatory pressures on local lending institution. Community organizers were pressuring local banks into bad loans.

As school yard wimps know, the solution to a school yard bully is a big brother.

My take is that the small banks saw the writing on the wall. They saw that the changing regulations and attitudes towards mortgages made their small business plans tenuous. So, the solution is to seek protection in a bigger, politically powerful firm.

We saw a similar merger strategy in the WorldCom fiasco. A large number of marginal companies merged creating the semblance of growth. Eventually the company collapsed.

Truth be told, I was actually more disheartened by the rise of Washington Mutual from a wonderful little local mutual fund to a banking behemoth. I extracted the list of WaMu acquistions from Wikipedia.

- Old Stone Bank of Washington, FSB, Rhode Island, 1990

- Frontier Federal Savings Association, Washington, 1990

- Williamsburg Federal Savings Association, Utah, 1990

- Vancouver Federal Savings Bank, Washington, 1991

- CrossLand Savings FSB, Utah, 1991

- Sound Savings & Loan Association, Washington, 1991

- Great Northwest Bank, Washington, 1992

- Pioneer Savings Bank, Washington, 1993

- Pacific First Bank, Ontario, 1993

- Far West Federal Savings Bank, Oregon, 1994

- Summit Savings Bank, Washington, 1994

- Olympus Bank FSB, Utah, 1995

- Enterprise Bank, Washington, 1995

- Western Bank, Oregon, 1996

- Utah Federal Savings Bank, 1996

- Keystone Holdings, Inc. (American Savings Bank), California, 1996

- United Western Financial Group, Inc., Utah, 1997

- Great Western Bank, 1997

- H. F. Ahmanson & Co. (Home Savings of America), California, 1998

- Industrial Bank, California, 1998

- Long Beach Financial Corp., California, 1999

- Alta Residential Mortgage Trust, California, 2000

- PNC Mortgage, Illinois, 2001

- Bank United Corp., Texas, 2001

- Fleet Mortgage Corp., South Carolina, 2001

- Dime Bancorp, Inc., New York, 2002

- HomeSide Lending, Inc., Florida, a unit of National Australia Bank, 2002

- Providian Financial Corporation, California, 2005

- Commercial Capital Bancorp, California, 2006

Quite frankly, I was more disheartened by the slow played drama of all these wonderful little banks being vacuumed up by a corporate giant, than in watching the thunderous collapse of the corporate giant.

Mergers are not one sided. Yes, some mergers are the result of hostile take overs. My understanding in the Washington Mutual expansion is that many of the small banks were seeking protection of a larger company. Regulations like the Community Re-investment Act (established in 1977 and greatly expanded in 1995), put tremendous regulatory pressures on local lending institution. Community organizers were pressuring local banks into bad loans.

As school yard wimps know, the solution to a school yard bully is a big brother.

My take is that the small banks saw the writing on the wall. They saw that the changing regulations and attitudes towards mortgages made their small business plans tenuous. So, the solution is to seek protection in a bigger, politically powerful firm.

We saw a similar merger strategy in the WorldCom fiasco. A large number of marginal companies merged creating the semblance of growth. Eventually the company collapsed.

Saturday, September 27, 2008

National Hunting and Fishing Day

Today is National Hunting and Fishing Day. It is a day in which we celebrate and engage in the cultural activities of hunting and fishing.

After a great deal of thought, and carefully planned experimentation, I have decided to come out in opposition to very concept behind this event.

While Hunting and Fishing Day seems like great excuse to go out into the woods and drink beer, I am now of the opinion that combining fishing and hunting on the same trip will lead to a tragic end.

First off, it is really hard to shoot a fish. The surface of the water refracts light. The fish wiggles, and the water seems to change the trajectory of the bullet. If, by some miracle, you hit a fish; it is really hard to get a shot fish out of the water.

On the big game side of the equation: I had a bear of a time figuring out the right bait for moose. When I finally hooked one, I found that reeling it in was a bigger challenge than I was ready to handle. Moose are big and they anchor in with those four massive hooves. I mean, a wild moose is like solid muscle. I declare, if I hadn't tied myself to a tree; it would have reeled me in.

I think that combining fishing and hunting is a big mistake. I am now inclined to either fish or hunt. No more of this fishing and hunting stuff for me. It is just too confusing. You get back to camp and end up gutting the rabbit and skinning the trout.

I know folk like trying to multitask these days, however, I strongly advise the public against creative ideas that combine the sports.

Throwing a fishing net at a grizzly just makes it mad. Thank God for trees, especially the tall sturdy type.

And, if you do find yourself standing on an inflatable raft in the middle lake blasting at fish with a shot gun, well, it is extremely likely that you will pop the boat and have to swim to shore, spilling the beer, ruining your gun and your portable TV.

After a great deal of thought, and carefully planned experimentation, I have decided to come out in opposition to very concept behind this event.

While Hunting and Fishing Day seems like great excuse to go out into the woods and drink beer, I am now of the opinion that combining fishing and hunting on the same trip will lead to a tragic end.

First off, it is really hard to shoot a fish. The surface of the water refracts light. The fish wiggles, and the water seems to change the trajectory of the bullet. If, by some miracle, you hit a fish; it is really hard to get a shot fish out of the water.

On the big game side of the equation: I had a bear of a time figuring out the right bait for moose. When I finally hooked one, I found that reeling it in was a bigger challenge than I was ready to handle. Moose are big and they anchor in with those four massive hooves. I mean, a wild moose is like solid muscle. I declare, if I hadn't tied myself to a tree; it would have reeled me in.

I think that combining fishing and hunting is a big mistake. I am now inclined to either fish or hunt. No more of this fishing and hunting stuff for me. It is just too confusing. You get back to camp and end up gutting the rabbit and skinning the trout.

I know folk like trying to multitask these days, however, I strongly advise the public against creative ideas that combine the sports.

Throwing a fishing net at a grizzly just makes it mad. Thank God for trees, especially the tall sturdy type.

And, if you do find yourself standing on an inflatable raft in the middle lake blasting at fish with a shot gun, well, it is extremely likely that you will pop the boat and have to swim to shore, spilling the beer, ruining your gun and your portable TV.

Shorts Say WooHoo!

DeepCapture has a good presentation of how Failure to Delivers destroy equity in this graph of the fall of WaMu. A Failure to Deliver shows up three days after a transaction.

An FTD happens when the person purchasing a stock does not receive the stock purchased. The FTDs in the collapse of WaMu are phantom shares. The ability of brokerage firms to create phantom shares added 50% to the decline in the stock accelerating the demise of WaMu.

As noted in Disciplined Shorts, there are two ways to cause an FTD. You can sell a stock without bothering to locate the a share to sell. Or you borrow a share, and that share gets sold before you buy back.

It is a joke that such a system happens in this world of real time communications. The regulators have rigged the game to transfer massive sums of capital from investors to hedgefunds and brokers. The system of regulations that have been designed jointly by our Democratic and Republican leaders is the leading cause of the growing gap between rich and poor.

BTW, I am not impressed by the fact that Warren Buffet is Obama's advisor as he has proven to be adept at manipulating the system to his advantage. Buffet's game is that of a takeover artist. I would want an advisory board with people whose primary concern is building and creating new technologies, rather than people skilled at taking over the creations of others.

An FTD happens when the person purchasing a stock does not receive the stock purchased. The FTDs in the collapse of WaMu are phantom shares. The ability of brokerage firms to create phantom shares added 50% to the decline in the stock accelerating the demise of WaMu.

As noted in Disciplined Shorts, there are two ways to cause an FTD. You can sell a stock without bothering to locate the a share to sell. Or you borrow a share, and that share gets sold before you buy back.

It is a joke that such a system happens in this world of real time communications. The regulators have rigged the game to transfer massive sums of capital from investors to hedgefunds and brokers. The system of regulations that have been designed jointly by our Democratic and Republican leaders is the leading cause of the growing gap between rich and poor.

BTW, I am not impressed by the fact that Warren Buffet is Obama's advisor as he has proven to be adept at manipulating the system to his advantage. Buffet's game is that of a takeover artist. I would want an advisory board with people whose primary concern is building and creating new technologies, rather than people skilled at taking over the creations of others.

Centralization

In the first presidential debate, Barack Obama did a great job framing the mortgage crisis as one of regulation v. deregulation.

Republicans would be wise to reframe the issue as a question of centralization v. decentralization. FannieMae and FreddieMac were creations of the New Deal which effectively centralized the mortgage industry by giving a tacit understanding that the mortgages were backed by the US taxpayers.

The centralization created this strange thing that unified all of the mortgage markets across the country (and even parts of the world) into one big top heavy market.

The fault of the Republicans is that they failed to realize that centralization is a worse problem than regulation. They were happy to privative the centralized regulatory market; however that market was inherently instable. To make deregulation work, one most completely break the centralized regulatory mechanisms.

Obama's claim is that a regulator jumping up and down on the starboard side of the centralized mortgage market could keep it stable. The truth of the matter is that no markets are ever stable.

Rebuilding the centralized regulatory mechanism might give a moments sense of stability; however, we are just setting ourselves up again for a new crash.

Rather than rebuilding the economy based on tools for a rigid economy. We should realize that markets are fluid and transition our economy from rigid investment tools like mortgages and interest bearing loans to securities that share risks and equity in a fluid market.

Republicans would be wise to reframe the issue as a question of centralization v. decentralization. FannieMae and FreddieMac were creations of the New Deal which effectively centralized the mortgage industry by giving a tacit understanding that the mortgages were backed by the US taxpayers.

The centralization created this strange thing that unified all of the mortgage markets across the country (and even parts of the world) into one big top heavy market.

The fault of the Republicans is that they failed to realize that centralization is a worse problem than regulation. They were happy to privative the centralized regulatory market; however that market was inherently instable. To make deregulation work, one most completely break the centralized regulatory mechanisms.

Obama's claim is that a regulator jumping up and down on the starboard side of the centralized mortgage market could keep it stable. The truth of the matter is that no markets are ever stable.

Rebuilding the centralized regulatory mechanism might give a moments sense of stability; however, we are just setting ourselves up again for a new crash.

Rather than rebuilding the economy based on tools for a rigid economy. We should realize that markets are fluid and transition our economy from rigid investment tools like mortgages and interest bearing loans to securities that share risks and equity in a fluid market.

Friday, September 26, 2008

The Blame Game

The pundits are wrong. I keep hearing people who frame the bailout as a case of evil investors taking unnecessary gambles, and that society as a whole must now pay for those gambles.

The problem is the opposite. In recent years the market has been driven by an investment paradigm designed to eliminate risk. The investment community has been driven by banks and investment funds trying to get out of risky things like stocks and into secured investments like government backed mortgage securities.

Corporate investment of late has been driven by a new type of investor called a hedge fund. By definition, a hedge fund is a group of people using a mix of equities to hedge their risk. Like other banks, their formulas rely heavily on leveraging government backed mortgages.

Don't you see? The market was not driven by people seeking risky investments! The market was driven by people looking for hedged investments reinsured by the Federal Government. There was a tremendous demand for government backed mortgages to suit the myriad of investment schemes created by risk adverse banks and hedge funds. The mortgage companies responded to and filled that need.

Driven by aversion to risk, leading investors and hedge funds have essentially pulled their equity out of the market and have it locked in trading strategies designed to hedge risk.

The only possible boogeyman in the situation is the frontline mortgage agent who bought the line that they were helping people live the American dream by putting them in a house they could not afford.

It is possible to lay blame for the dotcom bust on the irrational exhuberance of risk takers. The crash of 2008 is a crash driven by aversion to risk.

For example the mark to market accounting rules is causing businesses to fail that actually have a healthy mix of equities but are just suffering from the fact that no-one is currently buying equities.

The reason I've been pounding out blog posts about securities like mortgages and short orders is to show how our financial institutions are building houses of cards on securities which are simply too far divorced from reality to be stable investing tools.

We need to realize that our current problems are driven by the mix of tools on the market. The blame is not with the people.

The problem is the opposite. In recent years the market has been driven by an investment paradigm designed to eliminate risk. The investment community has been driven by banks and investment funds trying to get out of risky things like stocks and into secured investments like government backed mortgage securities.

Corporate investment of late has been driven by a new type of investor called a hedge fund. By definition, a hedge fund is a group of people using a mix of equities to hedge their risk. Like other banks, their formulas rely heavily on leveraging government backed mortgages.

Don't you see? The market was not driven by people seeking risky investments! The market was driven by people looking for hedged investments reinsured by the Federal Government. There was a tremendous demand for government backed mortgages to suit the myriad of investment schemes created by risk adverse banks and hedge funds. The mortgage companies responded to and filled that need.

Driven by aversion to risk, leading investors and hedge funds have essentially pulled their equity out of the market and have it locked in trading strategies designed to hedge risk.

The only possible boogeyman in the situation is the frontline mortgage agent who bought the line that they were helping people live the American dream by putting them in a house they could not afford.

It is possible to lay blame for the dotcom bust on the irrational exhuberance of risk takers. The crash of 2008 is a crash driven by aversion to risk.

For example the mark to market accounting rules is causing businesses to fail that actually have a healthy mix of equities but are just suffering from the fact that no-one is currently buying equities.

The reason I've been pounding out blog posts about securities like mortgages and short orders is to show how our financial institutions are building houses of cards on securities which are simply too far divorced from reality to be stable investing tools.

We need to realize that our current problems are driven by the mix of tools on the market. The blame is not with the people.

Thursday, September 25, 2008

Bailout Plan

I am happy to finally see a few Republicans openly acting like Republicans and voicing loud opposition to the bailout plan. I wish they had been louder in the demand to reign in FreddieMac and FannieMae. Yes, the cartoon characters were creations of FDR making them sacrosanct to the believers of the Democratic Party think; however failure to let opposition be known created the opportunity for the media to frame the programs as creations of George W. Bush.

I think Bush made a big mistake in trying to position the bailout as a creation of his administration when the creation currently being considered is actually quite bipartisan. Perhaps the most important part of the art of compromise is that one needs to let the opposition share claim. On that note, McCain has a history of sharing credit on legislation.

IMHO, in a healthy system of discourse, people would very clearly express uncompromised versions of their ideas. When making compromises with the opposition, they would share credit while letting the nature of the compromise be known. Perhaps the best example of a compromise is the 3/5th rule. Opponents to slavery weren't able to resolve the issue. Realizing that slaves would not be allowed to vote, they pushed an absurd compromise that slaves would count as only 3/5th a person in the enumeration used to distribute Congressional districts.

I think one of the reasons that Bush comes off as so uncompromising to the public is that he keeps positioning compromises as his creation.

I am really happy to see Republicans coming out and sounding like Republicans.

Unfortunately, I think Congress has no choice but to pass the silly bailout program and get to work buying up the "toxic mortgages" to restore liquidity to the market.

I happen to believe in people. Most people work hard to pay their debts. As such, I supect that the "toxic mortgage" portfolios are worth more than the current market price. I suspect that the true value of the portfolios lies somewhere between the current market price and the book price.

The reason the Federal Government has to get involved in the bailout is that FDR's bastard children FannieMae and FreddieMac made the financial world a tacit promise that big daddy federal government would back up the loans. Failure to live up to this promise would have long term ramifications.

Now that FannieMae and FreddieMac are officially listed among the failed New Deal programs, I hope that our society undergoes a deep conversation about the nature of mortgages and how mortgage financing inherently instable and that we need a mechanism where the property owner and lender share the equity and risk related to a property rather than this system that forces an onerous burden of debt on the public.

I think Bush made a big mistake in trying to position the bailout as a creation of his administration when the creation currently being considered is actually quite bipartisan. Perhaps the most important part of the art of compromise is that one needs to let the opposition share claim. On that note, McCain has a history of sharing credit on legislation.

IMHO, in a healthy system of discourse, people would very clearly express uncompromised versions of their ideas. When making compromises with the opposition, they would share credit while letting the nature of the compromise be known. Perhaps the best example of a compromise is the 3/5th rule. Opponents to slavery weren't able to resolve the issue. Realizing that slaves would not be allowed to vote, they pushed an absurd compromise that slaves would count as only 3/5th a person in the enumeration used to distribute Congressional districts.

I think one of the reasons that Bush comes off as so uncompromising to the public is that he keeps positioning compromises as his creation.

I am really happy to see Republicans coming out and sounding like Republicans.

Unfortunately, I think Congress has no choice but to pass the silly bailout program and get to work buying up the "toxic mortgages" to restore liquidity to the market.

I happen to believe in people. Most people work hard to pay their debts. As such, I supect that the "toxic mortgage" portfolios are worth more than the current market price. I suspect that the true value of the portfolios lies somewhere between the current market price and the book price.

The reason the Federal Government has to get involved in the bailout is that FDR's bastard children FannieMae and FreddieMac made the financial world a tacit promise that big daddy federal government would back up the loans. Failure to live up to this promise would have long term ramifications.

Now that FannieMae and FreddieMac are officially listed among the failed New Deal programs, I hope that our society undergoes a deep conversation about the nature of mortgages and how mortgage financing inherently instable and that we need a mechanism where the property owner and lender share the equity and risk related to a property rather than this system that forces an onerous burden of debt on the public.

Tuesday, September 23, 2008

Frontloaded Shorts

In the last post I discussed how a disciplined approach to shorts might reduce problems with failures to deliver and reduce the detrimental effects of short selling creating phantom shares which lead to an aritificial devaluing of a stock. Central to the process is the realization that, when a trader lends shares to a shorter, that trader is no longer an investor in stock. The trader has traded an investment in a company with a loan to a short seller.

In this post, I thought I would describe a different way to do a short sale. For wont of a better term, I decided to call this approach a frontloaded short.

In a frontloaded short, a trader owning shares of a company enters a deal with a short trader and sells his stock. Money from the sale drops into the account of the original stock owner. The two traders have a contract wherein the first trader will buyback the stock, and the two traders would settle the differential between the selling and repurchase price.

The main advantage of a frontloaded short is that the original investor is the holder of the money. This reduces the extent to which the person lending a stock becomes a creditor of the short seller. It also removes the temptation for people to short stocks as a capital raising mechanism.

BTW, it is possible in such a contract to add an escape clause for the short. The clause might say the shorter will skip the buy back and pay the difference in stock price to the original trader if the stock price hits a certain strike point. A short, after all, is not really an investment stock. A short is an off table deal made between two people gambling on the direction of the price with stocks as poker chips.

Now, if the short really is just a bet between two gamblers, one wonders if there is any value to involving real shares in the bet.

Reach Upward pointed me to a piece in the WSJ by L. Gordon Crovitz titled "Information Haves and Have Nots in which Mr. Crovitz claims that the vital role played by shorts is to provide information to the market. People who have information that a stock is overvalued short.

So, a primary reason that people want shorting is so that the sale provides information to the holders of shares of a stock that it is overvalued.

Unfortunately, this view is premised on a false assumptions that short sellers actually do have access to information not available to the rest of the investing world, and that short sellers are somehow altruistic fountains of virtue.

The reality is that people are very cunning. People are as apt to use the short process to create disinformation. Take over strategies almost always involve feints with shorts. Even worse, shorts often don't reflect information about the underlying security, but may be the result of a change in the internal trading strategy of a hedge fund.

If Mr. Covitz's assertion that shorts bring information to the market is correct. Then the massive short selling of 2008 should have resulted in a situation where prices are better known.

The reality appears to be the opposite. It appears that the massive short position has done little more than to give the financial market a wedgie. The market is more confused about prices than ever. People are having to give massive discounts to trade items magnify the liquidity crisis.

I am back to the opinion that the people who lend shares to shorters and the short sellers themselves are simply gamblers using stocks as poker chips. The information from this game is low quality and has effectively fogged the process of valuing properties.

As mentioned in the post Free Markets Don't Wear Shorts I contend that short selling (the selling of things that don't exist) is not something that would occur in a natural market. Short selling is an artificial device created by regulators that concentrate benefits on the few at the expense of the many.

Removing the regulations that allow shorting would be in order.

The proponents of short selling claim all sorts of altruistic motives for the shorts. Unfortunately, whether you frontload or backload the shorts, the shorts seem to do little more than divert large money from investments into a side show gaming market that ultimately undermines the market.

In this post, I thought I would describe a different way to do a short sale. For wont of a better term, I decided to call this approach a frontloaded short.

In a frontloaded short, a trader owning shares of a company enters a deal with a short trader and sells his stock. Money from the sale drops into the account of the original stock owner. The two traders have a contract wherein the first trader will buyback the stock, and the two traders would settle the differential between the selling and repurchase price.

The main advantage of a frontloaded short is that the original investor is the holder of the money. This reduces the extent to which the person lending a stock becomes a creditor of the short seller. It also removes the temptation for people to short stocks as a capital raising mechanism.

BTW, it is possible in such a contract to add an escape clause for the short. The clause might say the shorter will skip the buy back and pay the difference in stock price to the original trader if the stock price hits a certain strike point. A short, after all, is not really an investment stock. A short is an off table deal made between two people gambling on the direction of the price with stocks as poker chips.

Now, if the short really is just a bet between two gamblers, one wonders if there is any value to involving real shares in the bet.

Reach Upward pointed me to a piece in the WSJ by L. Gordon Crovitz titled "Information Haves and Have Nots in which Mr. Crovitz claims that the vital role played by shorts is to provide information to the market. People who have information that a stock is overvalued short.

So, a primary reason that people want shorting is so that the sale provides information to the holders of shares of a stock that it is overvalued.

Unfortunately, this view is premised on a false assumptions that short sellers actually do have access to information not available to the rest of the investing world, and that short sellers are somehow altruistic fountains of virtue.

The reality is that people are very cunning. People are as apt to use the short process to create disinformation. Take over strategies almost always involve feints with shorts. Even worse, shorts often don't reflect information about the underlying security, but may be the result of a change in the internal trading strategy of a hedge fund.

If Mr. Covitz's assertion that shorts bring information to the market is correct. Then the massive short selling of 2008 should have resulted in a situation where prices are better known.

The reality appears to be the opposite. It appears that the massive short position has done little more than to give the financial market a wedgie. The market is more confused about prices than ever. People are having to give massive discounts to trade items magnify the liquidity crisis.

I am back to the opinion that the people who lend shares to shorters and the short sellers themselves are simply gamblers using stocks as poker chips. The information from this game is low quality and has effectively fogged the process of valuing properties.

As mentioned in the post Free Markets Don't Wear Shorts I contend that short selling (the selling of things that don't exist) is not something that would occur in a natural market. Short selling is an artificial device created by regulators that concentrate benefits on the few at the expense of the many.

Removing the regulations that allow shorting would be in order.

The proponents of short selling claim all sorts of altruistic motives for the shorts. Unfortunately, whether you frontload or backload the shorts, the shorts seem to do little more than divert large money from investments into a side show gaming market that ultimately undermines the market.

Monday, September 22, 2008

Disciplined Shorts

There are two ways to get naked. You can run out in the street with no shorts, or you can run out in the street and drop the shorts.

In the debate on naked shorts, most people are concentrating on cases when a shorter sells shares without bothering to locate shares to sell. The second way of going naked happens when a person loans shares to a short then goes out and sells the same shares.

Now that there is a number of hedgefunds with strategies that hold short positions for long durations, the second path of going naked is probably more prevalent than the first.

Both of these practices have the effect of creating phantom shorts. The practice of selling things often manifests as Failure to Deliver. In an FtD, the person buying the share of a stock doesn't get the product purchased. The brokerages just shuffle paper around and try to look innocent when questioned.

Failure to Delivery is just a symptom of the problem. The serious problem is that the undisciplined shorting that allows multiple investors simultaneously hold the same share creates phantom stock. The phantom stock adds to the stock floating on the market and effectively diminishes the market value of a company.

One possible solution to the ill effects of undisciplined shorting is to demand discipline.

In a disciplined shorting regimen, the investor would lend the stock to a short trader that the short trader can sell on the market. This stock would then be replaced by a promissory note who promises to replace the stock with a given set of conditions. Note, the investor no longer has the stock. He has a promissory note from the trader. The investor could not sell the promissory note as stock as the promissory note is not stock. The investor could not vote in corporate elections as the investor doesn't own the stock anymore.

It is important for people to remember. The second an investor lends shares to a short, they are no longer an investor owning a piece of a company. They are a speculator playing a funny money game of chicken with a short seller. The share lends should share the risk of the speculative game.

If the short seller falls into financial difficulties, then the investor who loaned the shares in lieu of a promissory note should stand in line with the rest of the trader's creditors. This system makes sense because, when an investor loans stock to a trader, they are no longer an investor in the company at hand. By lending the stock to the trader, they are an investor in the trader.

If the investor needs to liquidate, they could sell the promissory note. The price of the note is likely to be somewhere between the face value of the note and the current market price of the stock.

The goal of disciplined investing is to make sure everyone knows what they have at each point in a transaction. Discipline shorting prevents anyone from trading something that they don't own (creating FtDs or phantom float).

One interesting aspect of disciplined investing is that it would effectively put time limits on short positions as the people lending stock are unlikely to lend stock for longer durations. For that matter, you would probably want to structure the market so that the people lending stock could set an outer buyback date.

A disciplined short structure might make it difficult for hedge funds looking to take large long duration short positions as part of their hedge formula. But, guess what? There is absolutely nothing in the laws of universal karma that says we need to structure our market for the needs of people who are seeking to avoid the risks that the rest of society must bear.

In the debate on naked shorts, most people are concentrating on cases when a shorter sells shares without bothering to locate shares to sell. The second way of going naked happens when a person loans shares to a short then goes out and sells the same shares.

Now that there is a number of hedgefunds with strategies that hold short positions for long durations, the second path of going naked is probably more prevalent than the first.

Both of these practices have the effect of creating phantom shorts. The practice of selling things often manifests as Failure to Deliver. In an FtD, the person buying the share of a stock doesn't get the product purchased. The brokerages just shuffle paper around and try to look innocent when questioned.

Failure to Delivery is just a symptom of the problem. The serious problem is that the undisciplined shorting that allows multiple investors simultaneously hold the same share creates phantom stock. The phantom stock adds to the stock floating on the market and effectively diminishes the market value of a company.

One possible solution to the ill effects of undisciplined shorting is to demand discipline.

In a disciplined shorting regimen, the investor would lend the stock to a short trader that the short trader can sell on the market. This stock would then be replaced by a promissory note who promises to replace the stock with a given set of conditions. Note, the investor no longer has the stock. He has a promissory note from the trader. The investor could not sell the promissory note as stock as the promissory note is not stock. The investor could not vote in corporate elections as the investor doesn't own the stock anymore.

It is important for people to remember. The second an investor lends shares to a short, they are no longer an investor owning a piece of a company. They are a speculator playing a funny money game of chicken with a short seller. The share lends should share the risk of the speculative game.

If the short seller falls into financial difficulties, then the investor who loaned the shares in lieu of a promissory note should stand in line with the rest of the trader's creditors. This system makes sense because, when an investor loans stock to a trader, they are no longer an investor in the company at hand. By lending the stock to the trader, they are an investor in the trader.

If the investor needs to liquidate, they could sell the promissory note. The price of the note is likely to be somewhere between the face value of the note and the current market price of the stock.

The goal of disciplined investing is to make sure everyone knows what they have at each point in a transaction. Discipline shorting prevents anyone from trading something that they don't own (creating FtDs or phantom float).

One interesting aspect of disciplined investing is that it would effectively put time limits on short positions as the people lending stock are unlikely to lend stock for longer durations. For that matter, you would probably want to structure the market so that the people lending stock could set an outer buyback date.

A disciplined short structure might make it difficult for hedge funds looking to take large long duration short positions as part of their hedge formula. But, guess what? There is absolutely nothing in the laws of universal karma that says we need to structure our market for the needs of people who are seeking to avoid the risks that the rest of society must bear.

Sunday, September 21, 2008

Changing the Slogans

I was watching a TV show on the horrors of climate change. During the commercial break there was an ad with a well known politicians demanding change. We have one party that simultaneously is demanding change and recoiling at the prospects of change.

Of course, a week earlier I heard a politician of the other party talking about how the free market will grow us out of the current economic malaise.

The sloganeering makes my brain scream. As you see, the free market is not about growth. The free market is about freedom. Free people optimize their resources to live the life they want to realize. Yes, moving from a controlled state to a free state generally creates a period of growth. Freedom, not growth, is the aim of the free society.

Here is another icky slogan:

John Whitesides, Political Correspondent, has a piece on Reuters saying: "Democrat Barack Obama accused Republican presidential rival John McCain on Saturday of wanting to gamble with the retirement savings and health care of Americans by subjecting them to the uncertainty of open markets."

The slogan is compelling. However the slogan was made while America is reeling from the failure of a big government program designed to save us all from the risk of the market. The slogan is based on the assumption that the people in this country are nitwits.

The American people are forced to pay a tremendous price tag for all of these programs designed to protect us from risk.

Which is a bigger gamble? Accepting that the markets are fluid and that the best path to long term security is for individuals to have diversified portfolios, or is it a bigger gamble to lump everyone's fate in a single package that, no matter which party rules, will be controlled by political cronies? Even without the cronism, such a globally bundled security mechanism is bound to lead to even greater instability than the instability the package was designed to contain.

The libertarians are as bad as the political parties. I was infuriated by a blog post by Brian Doherty of Reason Magazine inwhich Doherty tried to claim that investors should be free to engage in coercive takings (ie, shorting).

The pundits (left, right and libertarian) are all engaged in mindless sloganeering and are failing to see the issues behind our political and economic malaise.

Of course, a week earlier I heard a politician of the other party talking about how the free market will grow us out of the current economic malaise.

The sloganeering makes my brain scream. As you see, the free market is not about growth. The free market is about freedom. Free people optimize their resources to live the life they want to realize. Yes, moving from a controlled state to a free state generally creates a period of growth. Freedom, not growth, is the aim of the free society.

Here is another icky slogan:

John Whitesides, Political Correspondent, has a piece on Reuters saying: "Democrat Barack Obama accused Republican presidential rival John McCain on Saturday of wanting to gamble with the retirement savings and health care of Americans by subjecting them to the uncertainty of open markets."

The slogan is compelling. However the slogan was made while America is reeling from the failure of a big government program designed to save us all from the risk of the market. The slogan is based on the assumption that the people in this country are nitwits.

The American people are forced to pay a tremendous price tag for all of these programs designed to protect us from risk.

Which is a bigger gamble? Accepting that the markets are fluid and that the best path to long term security is for individuals to have diversified portfolios, or is it a bigger gamble to lump everyone's fate in a single package that, no matter which party rules, will be controlled by political cronies? Even without the cronism, such a globally bundled security mechanism is bound to lead to even greater instability than the instability the package was designed to contain.

The libertarians are as bad as the political parties. I was infuriated by a blog post by Brian Doherty of Reason Magazine inwhich Doherty tried to claim that investors should be free to engage in coercive takings (ie, shorting).

The pundits (left, right and libertarian) are all engaged in mindless sloganeering and are failing to see the issues behind our political and economic malaise.

Saturday, September 20, 2008

Can The Market Heal Itself?

The knee jerk reaction to crisis is for people to seek help from the Federal Government.

I was just asking myself if the market could heal itself.

In previous posts I noted that self-interested companies would not allow their stock to be shorted.

In regards to shorting, the problem could be resolved by structuring the market so that the voices of the company's could be heard.

My first thought was to create a petition to be passed among shareholders and CEOs. The petition would give the big exchanges (NASDAQ, NYSE and AMEX) the ultimatum: "Stop the practice of shorting or we will pull our company from your exchange."

As shorting increases the float of a stock, thus reducing the value of stock, the self-interested stock holders and CEOs would be tempted to sign the ultimatum. Fearing a customer revolt that could dramatically reduce the size of their exchange, the stock exchanges have a big incentive to clean up their act.

Unfortunately, even if the exchanges wanted to clean up their act, they may be prevented from acting by a weird Fannie Mae, quasi government company called the DTCC.

The problem with this idea is that companies would have no place to go to exchange their stock.

So, for the ultimatum to work, one would need to create a new exchange. The new exchange would be structured as a buyer's coop. The exchange and trading procedures would be designed by the member companies. The exchange could do real time clearing of transactions. The exchange would then be in a position to structure the use of shorts and other derivatives so that they are more favorable to the companies.

The NYSE and NASDAQ are exchanges that were structured around the desires of the brokerage firms. The new exchange could be structured around the desires of businesses and end investors.

The threat of a new exchange appearing on the market might be enough to transform the market. On further thought, I think the market might benefit more from the appearance of different exchanged honed to different needs.

A market dominated by just a few big companies has a hard time making corrections, while one with a large number of small companies is quick to react.

** I assert that that the new thinking about shorts have created a market climate where companies are tempted to pull out of the market. I thought I should point out in the last few years, the IPO market has slowed to a crawl while a growing number of firms have gone private or have sought the protection of a private equity firm. The "no shirt ultimatum" would turn a trickle into a deluge.

I was just asking myself if the market could heal itself.

In previous posts I noted that self-interested companies would not allow their stock to be shorted.

In regards to shorting, the problem could be resolved by structuring the market so that the voices of the company's could be heard.

My first thought was to create a petition to be passed among shareholders and CEOs. The petition would give the big exchanges (NASDAQ, NYSE and AMEX) the ultimatum: "Stop the practice of shorting or we will pull our company from your exchange."

As shorting increases the float of a stock, thus reducing the value of stock, the self-interested stock holders and CEOs would be tempted to sign the ultimatum. Fearing a customer revolt that could dramatically reduce the size of their exchange, the stock exchanges have a big incentive to clean up their act.

Unfortunately, even if the exchanges wanted to clean up their act, they may be prevented from acting by a weird Fannie Mae, quasi government company called the DTCC.

The problem with this idea is that companies would have no place to go to exchange their stock.

So, for the ultimatum to work, one would need to create a new exchange. The new exchange would be structured as a buyer's coop. The exchange and trading procedures would be designed by the member companies. The exchange could do real time clearing of transactions. The exchange would then be in a position to structure the use of shorts and other derivatives so that they are more favorable to the companies.

The NYSE and NASDAQ are exchanges that were structured around the desires of the brokerage firms. The new exchange could be structured around the desires of businesses and end investors.

The threat of a new exchange appearing on the market might be enough to transform the market. On further thought, I think the market might benefit more from the appearance of different exchanged honed to different needs.

A market dominated by just a few big companies has a hard time making corrections, while one with a large number of small companies is quick to react.

** I assert that that the new thinking about shorts have created a market climate where companies are tempted to pull out of the market. I thought I should point out in the last few years, the IPO market has slowed to a crawl while a growing number of firms have gone private or have sought the protection of a private equity firm. The "no shirt ultimatum" would turn a trickle into a deluge.

Changing the Messy Shorts

I guess it is now official. The bailout program passed by Congress failed. We know that it has officially failed because Congress is scrambling to pass another massive bailout.

I am looking at the financial market. The one thing that stands out in this market is a historic high in the number of shorts.

Shorts were created as a regulatory tool (See Free Markets Don't Wear Shorts). The idea is that shorts would be used as a tool to cap peaks by allowing an artificial increase in the float of a stock. The shorts would provide liquidity as shorters bought back in times of crisis.

What's happened in 2008 is that shorters increased their short positions during the economic downturn magnifying the current liquidity crisis. Shorters are not naturally inclined to buy back, and they are not providing liquity as expected. Instead, they are expanding their positions.

Since shorts were designed as a regulatory tool, I contend that regulators should use their power to regulate shorts before another dip into the taxpayers' pockets.

I contend that the SEC should expand its ban on shorts (essentially, the Feds should ban all short selling for the foreseeable future while aggressively investigating charges of criminal conspiracy in short selling). In 2009, the next Congress would take up the issue of whether or not to allow shorting.

The justification for shorting is that shorting provides a tool for regulating the market. Here is the catch, shorting only has value if the shorting is actively controlled by regulators. As the 2008 liquidity crisis proved, unregulated shorting simply increases the hardships of economic dips by artificially increasing the float of stock as the market falls.

I am looking at the financial market. The one thing that stands out in this market is a historic high in the number of shorts.

Shorts were created as a regulatory tool (See Free Markets Don't Wear Shorts). The idea is that shorts would be used as a tool to cap peaks by allowing an artificial increase in the float of a stock. The shorts would provide liquidity as shorters bought back in times of crisis.

What's happened in 2008 is that shorters increased their short positions during the economic downturn magnifying the current liquidity crisis. Shorters are not naturally inclined to buy back, and they are not providing liquity as expected. Instead, they are expanding their positions.

Since shorts were designed as a regulatory tool, I contend that regulators should use their power to regulate shorts before another dip into the taxpayers' pockets.

I contend that the SEC should expand its ban on shorts (essentially, the Feds should ban all short selling for the foreseeable future while aggressively investigating charges of criminal conspiracy in short selling). In 2009, the next Congress would take up the issue of whether or not to allow shorting.

The justification for shorting is that shorting provides a tool for regulating the market. Here is the catch, shorting only has value if the shorting is actively controlled by regulators. As the 2008 liquidity crisis proved, unregulated shorting simply increases the hardships of economic dips by artificially increasing the float of stock as the market falls.

See Thru Shorts

The mortgage mess, messy shorts and subsequent bank failures all seem to share a common theme. What is driving the current down cycle in the American economy is lack of clarity of ownership.

In the housing industry, we find that the very structure of the mortgage system clouds ownership. In the mortgage system the lender and borrower do not share the risk. The mortgage system, a homebuyer ends up with two two offsetting financial instruments. They have a deed to the property, and a loan from the bank. The value of the property is ruled by the local realty market. The loan is ruled by global money market.

The fact that these two financial instruments are ruled by two separate segments of the economy muddle the ownership of the property. This false economy creates artificial and destructive business cycles.

When people believe that values in the housing market will rise at a rate faster than the money market, people fall into a gambling spirit and buy more property than they need (in many cases they buy more than they can afford). The false economy creates a state of crisis when prices start falling.

The banks end up repossessing the properties that were leveraged in the boom. They are then left to dump the properties during a falling market magnifying the disconnect between the value of the property and global money market.

The short market muddles ownership in a more direct way. In the short process, a person sells a stock they do not own. In the last few years, it appears that many hedge funds have financial instruments that take long term or even perpetual short positions. These long short positions are diluting the ownership in a stock, and are adversely affecting the ability of companies to raise capital based on the market value of their business.

Pundits on TV are demanding greater transparency in the financial industry. I contend that the transparency problem is not simply a political problem. Our financial institutions have taken extraordinarily complex positions with derivates, mortgages and reinsurance that are simply too far removed from the underlying equities that support the securities.

Our financial institutions have built up an enormous house of cards that is logically detached from the real day to day economics that rule our lives.

The problem is not with a lack of transparency. The problem is that when we look at the complex financial arrangments of our banks in the light of a down market, we see that the complex financial models behind these institutions are divorced from reality.

A year ago, the big financial institutions thought they had the right mix of derivatives and reinsurance to handle any financial storm. They failed to realized that the derivatives and insurance programs we create to avert risks create a new layer of unforeseen risks.

My solution to the financial crisis is to replace mortgages with tools that create greater clarity of ownership, and to simply can the short industry which has proven itself to be something that magnifies the depths of a down cycle.

Yesterday, the SEC temporarily halted the shorting of financial stock (see PDF. That action reversed the spiraling crash of the financial sector.

In the housing industry, we find that the very structure of the mortgage system clouds ownership. In the mortgage system the lender and borrower do not share the risk. The mortgage system, a homebuyer ends up with two two offsetting financial instruments. They have a deed to the property, and a loan from the bank. The value of the property is ruled by the local realty market. The loan is ruled by global money market.

The fact that these two financial instruments are ruled by two separate segments of the economy muddle the ownership of the property. This false economy creates artificial and destructive business cycles.

When people believe that values in the housing market will rise at a rate faster than the money market, people fall into a gambling spirit and buy more property than they need (in many cases they buy more than they can afford). The false economy creates a state of crisis when prices start falling.

The banks end up repossessing the properties that were leveraged in the boom. They are then left to dump the properties during a falling market magnifying the disconnect between the value of the property and global money market.

The short market muddles ownership in a more direct way. In the short process, a person sells a stock they do not own. In the last few years, it appears that many hedge funds have financial instruments that take long term or even perpetual short positions. These long short positions are diluting the ownership in a stock, and are adversely affecting the ability of companies to raise capital based on the market value of their business.

Pundits on TV are demanding greater transparency in the financial industry. I contend that the transparency problem is not simply a political problem. Our financial institutions have taken extraordinarily complex positions with derivates, mortgages and reinsurance that are simply too far removed from the underlying equities that support the securities.

Our financial institutions have built up an enormous house of cards that is logically detached from the real day to day economics that rule our lives.

The problem is not with a lack of transparency. The problem is that when we look at the complex financial arrangments of our banks in the light of a down market, we see that the complex financial models behind these institutions are divorced from reality.

A year ago, the big financial institutions thought they had the right mix of derivatives and reinsurance to handle any financial storm. They failed to realized that the derivatives and insurance programs we create to avert risks create a new layer of unforeseen risks.

My solution to the financial crisis is to replace mortgages with tools that create greater clarity of ownership, and to simply can the short industry which has proven itself to be something that magnifies the depths of a down cycle.

Yesterday, the SEC temporarily halted the shorting of financial stock (see PDF. That action reversed the spiraling crash of the financial sector.

Thursday, September 18, 2008

Free Markets Don't Wear Shorts

The last post ended with the strange assertion that the practice of shorting would not exist in a truly free market.

A large number of pundits are using free market style rhetoric to support unrestricted trading of derivatives. My assertion is that the current mix of derivatives offered by the market are a creation of a regulatory regime. A truly free market would have a different mix of trading tools created by the owners of the assets traded.

Stock is a contract that allows joint ownership of a company. In an unregulated market, the people making the contract would spell out the rights entailed in the ownership of the contract.

I contend that the self interested parties writing the contracts would disallow the practice of shorting. Lending the stock to shorts causes an overall devaluation of the company. This is against the interest of the people selling the asset. Shorting also creates confusing ownership issues with both the person who lent their shares to shorts and the person who bought the borrowed shares behaving as if they owned stock.

With unregulated shorts, a person could buy a thousand shares. Short that thousand shares and buy another thouand shares. They could then claim to have twice the ownership rights in a company than their actual exposure to risk.

Practices that confuse or multiply ownership are not in the interest of the parties selling joint ownership of an asset.

Anyone who believes that shorting is a natural right, and that investors should be able to sell short with zero regulation must accept the practice of businesses shorting their own stock. In this case, you would see companies taking massive short positions to remove the positions from the market in an effort to protect their prime investors.

The logical trap we are in is that shorts were a creation of a regulatory regime. So, arguing for unregulated use of tools designed to regulate the market leads to logical paradoxes (a company shorting itself and confused ownership) and ultimately to a nihilistic behavior in the market.

A large number of pundits are using free market style rhetoric to support unrestricted trading of derivatives. My assertion is that the current mix of derivatives offered by the market are a creation of a regulatory regime. A truly free market would have a different mix of trading tools created by the owners of the assets traded.

Stock is a contract that allows joint ownership of a company. In an unregulated market, the people making the contract would spell out the rights entailed in the ownership of the contract.

I contend that the self interested parties writing the contracts would disallow the practice of shorting. Lending the stock to shorts causes an overall devaluation of the company. This is against the interest of the people selling the asset. Shorting also creates confusing ownership issues with both the person who lent their shares to shorts and the person who bought the borrowed shares behaving as if they owned stock.

With unregulated shorts, a person could buy a thousand shares. Short that thousand shares and buy another thouand shares. They could then claim to have twice the ownership rights in a company than their actual exposure to risk.

Practices that confuse or multiply ownership are not in the interest of the parties selling joint ownership of an asset.

Anyone who believes that shorting is a natural right, and that investors should be able to sell short with zero regulation must accept the practice of businesses shorting their own stock. In this case, you would see companies taking massive short positions to remove the positions from the market in an effort to protect their prime investors.

The logical trap we are in is that shorts were a creation of a regulatory regime. So, arguing for unregulated use of tools designed to regulate the market leads to logical paradoxes (a company shorting itself and confused ownership) and ultimately to a nihilistic behavior in the market.

My Own Private IPO

I thought I would log in to say that I throroughly applaud the current crackdown on and investigation of the abuses of short selling (financial post). While the theory of short selling makes some sense. The sheer volume of shorts in this last year seem to indicate that there has been a fundamental transition in the role of shorts in the market.

A short is an interesting financial tool.

If an investor feels that a stock is way overvalued, they can sell shares of the stock. They then buy back the stock at a later date.

In theory this process can help reduce the high of artificial peaks by creating additional selling pressure. The buying back of shorts creates some buying value for the stock with the price is weak.

In the last several years, the market has seen a transformation in the thinking about shorts. Hedge funds have started taking extremely large short positions and holding the positions long term. As I understand the goal is to mitigate risks through complex derivative formulas. Regardless of the reason, the new style of shorting is simply creating a downward pressure.

When average Joe investor shorts a stock, they have to pay an interest fee on the stock they borrowed. This creates an incentive to buy back the stock. Hudge funds are both the payers and recipients of huge amounts of short interest. Imagine buying 100 shares of stock, borrowing the stock from yourself then shorting the stock. You pay interest to yourself, and the deal is a wash.

If a hedge fund takes a massive short position without the intention of buying back the stock, they are, in effect, issuing an IPO against another person's assets.

The new thinking about shorts (ie, holding shorts long term) has changed the dynamics of valuing assets. A company that would earn a 10x market capitalization might only get an 8x price per earning in a market where is is common for hedge funds to take a 20% short position on the stock of a healthy profitable company. This massive dilution of market capital dramatically diminishes the ability of companies to use the capitalization of the firm for future expansion.

Let's try a different angle at this. A short is a thing called a derivative. The value of a short is derived from the value of another security. A derivatives market can help in the process of valuing securities in the market.

The danger of a derivatives market happens when the derivatives themselves become the primary focus of the investors. Our hedge funds and insurance companies are doing programmatic trading designed to mitigate risk. This massive programmatic trading is divorcing securities from the underlying value and underlying risks. The market is in chaos because it has lost its ability to value assets.

When the tail weighs less than the dog, the tail can wag along and help the dog as it runs through fields. Once the tail weighs more than the dog, the K9 unit simply flops around on the ground, and the tail wags the dog.

Unfortunately, the free marketeers of the world have been arguing for unrestricted use of derivatives. My position is way out in left field. I recognize that if you want to have derivatives, the derivatives have to be regulated. My inner Libertarian tells me that a functional free market may not have derivatives at all.

There are many voices on the net at the moment denouncing the current efforts to regulate short selling. I realize that derivatives only exist because the derivatives are defined by a regulatory authority.

A short is an interesting financial tool.

If an investor feels that a stock is way overvalued, they can sell shares of the stock. They then buy back the stock at a later date.

In theory this process can help reduce the high of artificial peaks by creating additional selling pressure. The buying back of shorts creates some buying value for the stock with the price is weak.

In the last several years, the market has seen a transformation in the thinking about shorts. Hedge funds have started taking extremely large short positions and holding the positions long term. As I understand the goal is to mitigate risks through complex derivative formulas. Regardless of the reason, the new style of shorting is simply creating a downward pressure.

When average Joe investor shorts a stock, they have to pay an interest fee on the stock they borrowed. This creates an incentive to buy back the stock. Hudge funds are both the payers and recipients of huge amounts of short interest. Imagine buying 100 shares of stock, borrowing the stock from yourself then shorting the stock. You pay interest to yourself, and the deal is a wash.

If a hedge fund takes a massive short position without the intention of buying back the stock, they are, in effect, issuing an IPO against another person's assets.

The new thinking about shorts (ie, holding shorts long term) has changed the dynamics of valuing assets. A company that would earn a 10x market capitalization might only get an 8x price per earning in a market where is is common for hedge funds to take a 20% short position on the stock of a healthy profitable company. This massive dilution of market capital dramatically diminishes the ability of companies to use the capitalization of the firm for future expansion.

Let's try a different angle at this. A short is a thing called a derivative. The value of a short is derived from the value of another security. A derivatives market can help in the process of valuing securities in the market.

The danger of a derivatives market happens when the derivatives themselves become the primary focus of the investors. Our hedge funds and insurance companies are doing programmatic trading designed to mitigate risk. This massive programmatic trading is divorcing securities from the underlying value and underlying risks. The market is in chaos because it has lost its ability to value assets.

When the tail weighs less than the dog, the tail can wag along and help the dog as it runs through fields. Once the tail weighs more than the dog, the K9 unit simply flops around on the ground, and the tail wags the dog.

Unfortunately, the free marketeers of the world have been arguing for unrestricted use of derivatives. My position is way out in left field. I recognize that if you want to have derivatives, the derivatives have to be regulated. My inner Libertarian tells me that a functional free market may not have derivatives at all.

There are many voices on the net at the moment denouncing the current efforts to regulate short selling. I realize that derivatives only exist because the derivatives are defined by a regulatory authority.

Wednesday, September 17, 2008

Defining Securities

It is easier to tear things down than build them up.

IMHO, one of the great faults of the libertarian movement is this absurd belief that everything businesses do is good. They are ways the businesses and packs of investors can attack people that are simply underhanded and destructive.

For example a publicly traded company might have a decent plan that it is executing okay. It is possible for a hedge fund conspiring with a pack of investors, bloggers and newsreporter (often from large attack journals like the NY Times) to hit the company with a massive naked short position. A few planted attack stories coupled with the steep drop in the share price can be enough to panic the people working with the company and topple an otherwise healthy firm. In reward for the attack, the attackers can walk away with a sizeable portion of the company's market value to use in their next attack.

I have been following the short positions on stocks for the last year. I am more worried now about the short position taken against the American business community than I am about the mortgage mess.

As people talk about reform, I hope people listen to voices like Patrick Byrne and not just politicos who are on the payroll of Fannie Mae.